Scalper.io is a breakthrough-algorithm software that does that perfectly. Sometime you may look for an indicator that can quickly provide you with the buying and selling signals data. The Exponential Moving Average Indicator is what you should look for. Scalpers get one of the best outcomes if their trades are worthwhile and may be repeated many occasions over the course of the day.

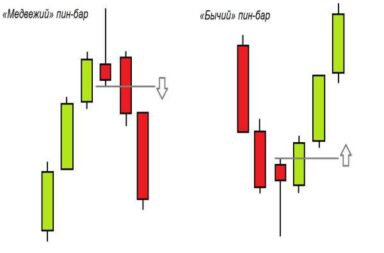

This indicator tells you about the market direction and provides you with entry and exit points. SAR stands for Stop And Reversal, which is a series of dots on the price bars. The trader has an edge as it tells you the movement of the underlying. Thus, here are four options for scalping strategy to guide you.

This script is what I call an entry helper as it calculates dynamically the position size,… This oscillator can be customized by adjusting the length of the Willy period, the length of Willy’s EMA, and the upper and lower bands. The upper and lower bands help traders identify overbought and oversold conditions. The WillyCycle Oscillator is a technical analysis tool used to measure the momentum of an asset and identify overbought and oversold conditions… For the best foreign exchange scalping systems, traders ought to first outline their targets. Of course, the purpose of entering the marketplace for traders is to realize profit, however when scalping you must keep in mind that the income will be low.

What are Scalping Indicators or Signals?

The primary strategy utilized by 1000pip Builder is to capture long-term trends through technical and fundamental analysis. It is important to note that Learn 2 Trade also provides separate crypto-based signals at similar membership prices. Learn 2 Trade offers a full 30-day money-back guarantee if you are unsatisfied with its service. It also provides a free trial with fewer weekly signals generated to test the platform. All packages provide up to three signals daily, with a very high success rate of 76%.

Scalpers prefer to attempt to scalp between five and 10 pips from each trade they make and to repeat this course of again and again all through the day. Pip is brief for “percentage in level” and is the smallest change value movement a foreign money pair can take. Using excessive leverage and making trades with just some pips profit at a time can add up. Forex scalping is a buying and selling type used by forex traders to buy or sell a forex pair after which hold it for a brief period of time in an try and make a profit. This caused occasion promoters to place restrictions on the number of tickets that can be purchased in a single transaction, which has significantly lowered unfair ticket pricing. Even if risking a small amount per commerce, taking many trades might mean a significant drawdown if lots of those trades end up being losers.

XAU/USD Bears Remain Resilient in Gold Price Forecast, Targeting … – FX Leaders

XAU/USD Bears Remain Resilient in Gold Price Forecast, Targeting ….

Posted: Fri, 17 Feb 2023 08:00:00 GMT [source]

Scalping is a trading style where the trader makes profits fromexp the minutest changes in the prices of financial security. This is considered one of the best methods to achieve financial objectives by doing goal based investing in India. Since 2017, AltSignals has been working hard to provide consumers with accurate information on forex assets through a team of expert trade analysts and entrepreneurs. With so many scammers on the market, it’s critical to rely on a reputable source with a track record of profitable deals. This platform also represents the ability to provide users with extensive analysis, which is something that most providers overlook.

Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Forex Scalping Definition

It shows traders the average price of their trades, over a specific time. Essentially, it helps traders understand whether the price of their securities, commodities, foreign exchange, etc., is moving up or down, thereby helping them to identify a trend. SMA is regarded as an arithmetic moving average in which traders typically add the recent closing prices and then divide the price by the number of periods to calculate the average. Unlike a variety of day trading strategies where you can have a win/loss ratio of lower than 50% and still earn cash, scalp merchants should have a excessive win/loss ratio. This is due to the fact that dropping and profitable trades are generally equal in measurement.

Bollinger Bands rely on a simple moving average with a standard deviation set above and below to show how volatile a market might be. Traders believe that wider standard deviations indicate increased volatility in and vice versa, if the bands are narrow it might mean that the market is stable. To the masses, finding the right entry and exit at the right time is a challenging and an emotional ride for both traders and investors. Timing the entry and exit point with precision without the need to “pray-and-hope for the best” mindset is key to successful trading and investing.

Scalping Strategies Futures

https://1investing.in/ use a convenient scalping indicator known as the Bollinger Bands. The markets are settling down for a tight range trading when the Bollinger Band line becomes flat. This wait for a pullback prevents you from entering into a long or short position just after a substantial price change has occurred.

Breaking Update: SEC Serves SushiSwap And Its CEO With … – FX Leaders

Breaking Update: SEC Serves SushiSwap And Its CEO With ….

Posted: Thu, 23 Mar 2023 07:00:00 GMT [source]

You should know how to calculate, apply, and interpret the technical analysis part correctly. However, in the case of short-term averages, you can expect a fast change. For that, you need to calculate the aggregate value of the recent closing prices, first. Then, you need you to figure out the number of periods the calculation average consists of, and add both the values. First of all, any trader should understand that learning the art of Scalping is challenging to say the least.

In order to make constant profit in the forex market, you need to make sure you have a strong buying and selling strategy, otherwise you lose money in trading. Always keep disciplined and trade with proper risk management factors to cut back your risk publicity in the market. Statistical traders search for patterns or anomalies that are inclined to happen given particular situations. This might embody buying/promoting and holding the place for five minutes if a certain chart sample appears at a certain time of day, for instance. Statistical foreign exchange scalping strategies are sometimes primarily based on time, value, day of the week, or chart patterns. Forex Scalping is a short-term strategy, the goal is to make profit out of tiny price movements.

This is the situation when traders have a better understanding of market behavior and, as a result, enhance their trading skills. A support team is ready to help with concerns and make recommendations. They are proud of the fact that 80,000 clients are actively using their services to achieve outstanding achievements. TweetShareShareEmailCommentsForex signals are a time-saving solution to every trader’s time-consuming task of identifying profitable trading chances at the proper time. In its most basic form, this signal is a trading recommendation for a specific financial instrument that should be performed at a specific price.

In scalp trading, is there any authorized limit for a turnover?

The signals provide the entry price, the take-profit level , and the stop-loss – the level that invalidates the signal). Additionally, each signal offers the amount of risk per trade and its risk-to-reward ratio. The forex market provides ample opportunities for traders to make money daily. With a very high level of liquidity and low volatility, the FX markets allow traders to go long and short on all major cryptocurrency pairs, such as EUR/USD and GBP/USD. Scalping requires focus and speed and it’s vital if trades want to be successful.

Thus, the change in why does ppo have to be 039 modified 039 of the dot depicts trend reversal is underway. It means that the broker and the currency pair must be chosen after detailed research to avoid any last-minute trading hassles. In this trading type, the success of a trade is heavily dependent on the execution of the trade, which is just a matter of seconds here. Therefore, try to avoid a broker with a dealing desk as they might reject the order execution. When Stochastic’s blue line crosses the red line to the downside and from inside the area above the 80 level, it should break and remain below the said level. Following a strategy that is heavily dependent on the chart, it is crucial to set the chart at the right conditions to reap the best of them.

- One way to look at this is to open positions according to the direction of the moving averages.

- This indicator is meant for stocks with a lot of price action and volatility, so for best results, use it on charts that move similar to the S&P 500 or other similar charts.

- It’s a simple and convenient method to stay informed, and all you need is an Internet connection.

If you need the pattern to be your good friend, you’d higher not let ADX become a stranger. The well timed nature of technical analysis makes real-time charts the device of alternative for forex scalpers. Day trading strategies demand utilizing the leverage of borrowed money to make earnings.

What is Scalping in Forex Trading

This chart overlay indicator has been developed for the low timeframe divergence scalper. The core idea is to earn small profits and accumulate them to reach their daily target. With the help of this tool, you can figure out the short-term momentum of any particular financial asset. It will also help you to know more about the trend, and even put a stop-loss order if necessary. Subsequently, the chart position of SAR falls below the price, if the market trend is upwards. Now once the core concept of Scalping is clear, we should know a bit about the indicators.

One thing that every trader must understand is there are thousands of indicators that you can use to perform technical analysis for Scalping. As Scalping demands a ton of information to reach the desired target, the traders do need these indicators. No matter what type a dealer chooses for his or her buying and selling, they need to ensure it fits them and that they really feel comfortable with it.

Rotter traded as much as a million contracts a day, and was in a position to develop a legendary status in certain circles, and has inspired forex merchants all around the world. While studying nicely-recognized strategies could be helpful, they should type the building blocks of your individual distinctive setup. The 1-minute forex scalping strategy is a straightforward strategy for novices that has gained popularity by enabling excessive buying and selling frequency. Bollinger Bands are an essential indicator in the share market that are like envelopes. Scalping is defined as a style of trading in which traders attempt to book profits off small changes in prices, typically after executing a trade and becoming profitable.

Bottom Line on Forex Scalping Strategy

While scalping makes an attempt to seize small gains, such as 5 to twenty pips per trade, the revenue on these trades could be magnified by growing the position size. Traders who use the day buying and selling technique are known as day traders available in the market. On the opposite hand, people who use the scalping to scalp the market are known as scalpers. One thing to keep in mind is that, day traders commerce the marketplace for a protracted time period, however closes it throughout the day, whereas scalpers scalp the market. If you take a look at the professional merchants in the United Kingdom, you will find each kinds of merchants as both of these systems are extremely worthwhile. The greatest buying and selling platform for CFD and forex scalping is arguably MetaTrader, with the MetaTrader Supreme Edition plugin.

Crypto Signals Brief January 9: Gaining Some Momentum on … – FX Leaders

Crypto Signals Brief January 9: Gaining Some Momentum on ….

Posted: Mon, 09 Jan 2023 08:00:00 GMT [source]

And each strategy, in addition to filters, should have MAIN indicator that gives a signal for the entry. And, maybe, the tool Scalper’s Dream will be such indicator for you. The indicator helps the intraday traders to make faster decisions.

IFCMARKETS. CORP. does not provide services for United States, BVI, Japan and Russian residents. Another thing that you should know is you usually need to use more than one indicator to get the desired reports. Together they will deliver the ultimate report that will help you to earn what your target is.

A Super Trend is a trend following indicator similar to moving averages. It is plotted on price and the current trend can simply be determined by its placement vis-a-vis price. It is a very simple indicator and is constructed with the help of just two parameters- period and multiplier. Different forex signal providers employ various strategies to identify potential trading opportunities. For example, some signal providers utilize artificial intelligence to identify possible trading setups.

The traders use varying periods like 5, 10, 50, 100, or more for SMA or EMA according to their preferences. One way to look at this is to open positions according to the direction of the moving averages. If the trade duration is 1 to 15 minutes, the trader must keep an eye on any significant price fluctuations.

Conversely, the indicator displays chart positions above the price during a downward trend, signaling traders that prices are retracting. The SAR indicator helps traders determine an asset’s future, short-term momentum and assists in understanding when and where to place a stop-loss order. The objective of scalping is to make a profit by buying or selling currencies and holding the position for a very brief time and shutting it for a small revenue. Many trades are placed throughout the buying and selling day using a system that’s usually based mostly on a set of indicators derived from technical evaluation charting tools.

.jpeg)